Economics and Business Student Association, Fall Quarter 2022 - Topic: Consulting

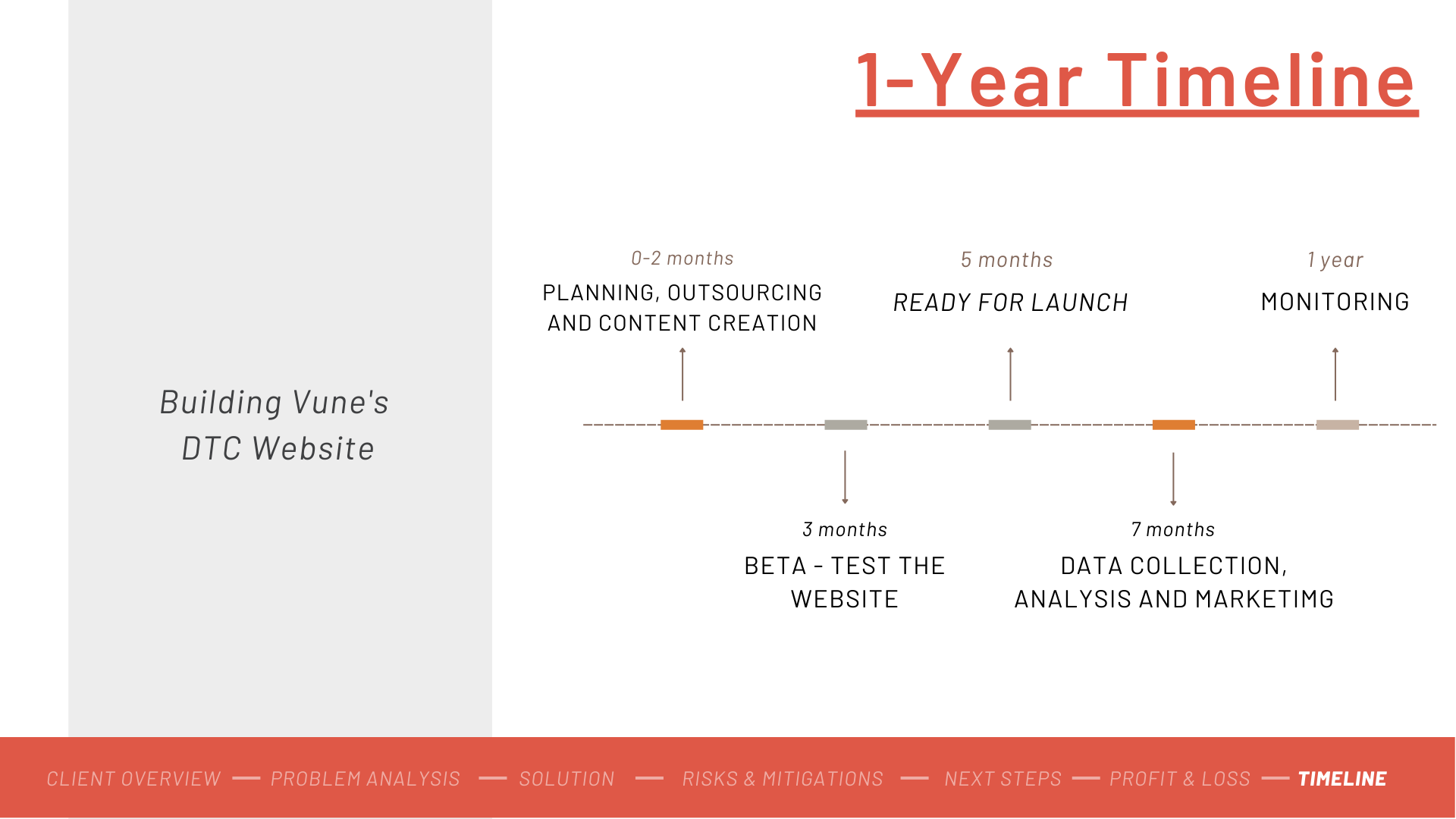

Conducted market research on the benefits and risks of switching to a DTC model and constructed a 1-year implementation timeline. Collaborated with 7 team members throughout the 8-week project timeline.

Description of Fall Quarter Prompt:

Company Background

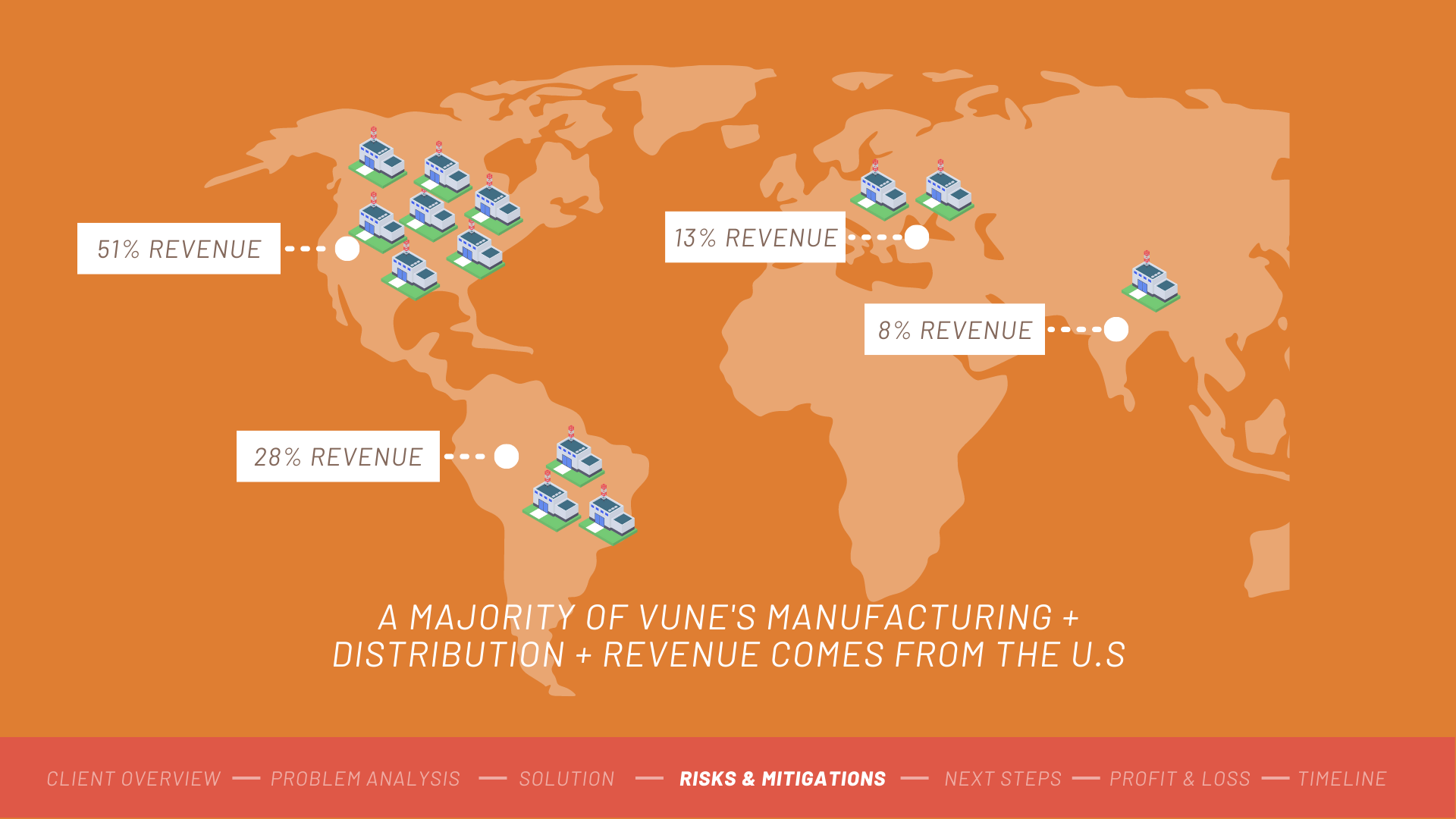

Vune is a prominent manufacturer, marketer, and designer of a range of durable consumer products such as coffee makers, toasters, blenders, mixers, and refrigerators. The company sells its products worldwide through distributors and retailers. Despite experiencing 15 quarters of stable earnings growth, Vune's earnings decreased in Q1 2020 due to poor retail conditions, slow consumer demand, higher raw material costs, and reduced manufacturing efficiency caused by the pandemic. However, the company's earnings rebounded in Q4 2020, and it has maintained a consistent cash position of 5% of total assets over the past 12 quarters due to prudent financial management.

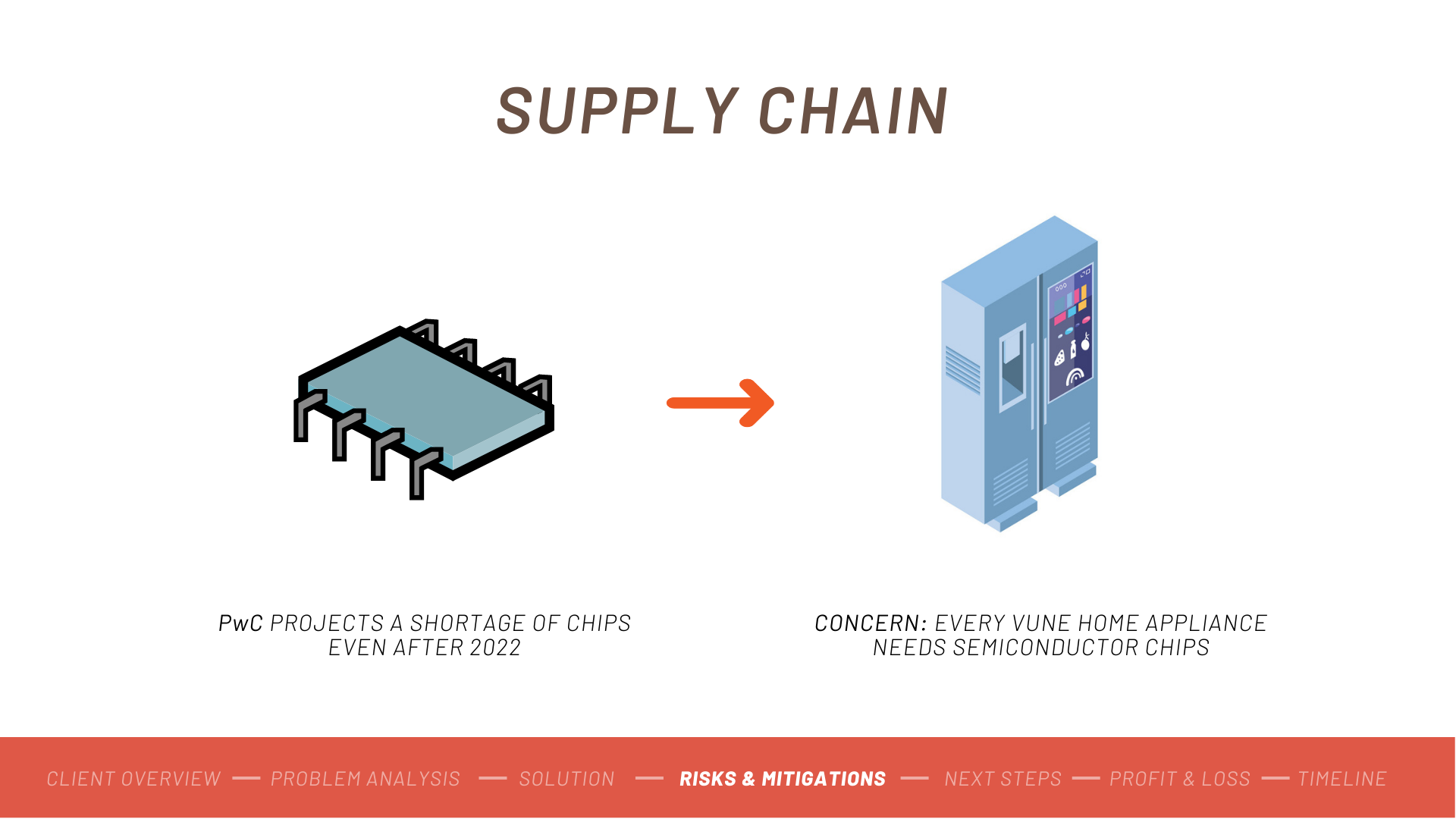

Marla Vune was appointed CEO of Vune in May 2017, and under her leadership, the company has made significant strides in launching a successful "smart" appliance product line that provides an integrated consumer experience. Although the pandemic has affected all of Vune's product lines, especially the "smart" appliances due to supply chain issues in the SOC market, the company remains focused on providing quality products and meeting customer demands.

Introduction

Based on current consumer buying trends (online/direct to consumer) for larger appliances, such as washers, dryers, or refrigerators, please be prepared to discuss the pros/cons of establishing a direct to consumer business model and your ultimate recommendation whether or not we should move forward. Do you feel selling directly online is a profitable business model that can elevate our brand and potentially lower costs? Why or why not?

Does your recommendation change if you consider small appliances, such as

toasters, coffee makers, or mixers?

What are your recommendations for immediate “next steps”?

Goals

Focusing on ways in meeting the demand of modern consumers by upgrading some of our traditional products to premium appliances that align with their expectations.

Expand our portfolio to include multi-functional, "smart" appliances, with the objective of offering our customers an integrated consumer experience through interconnected household devices.

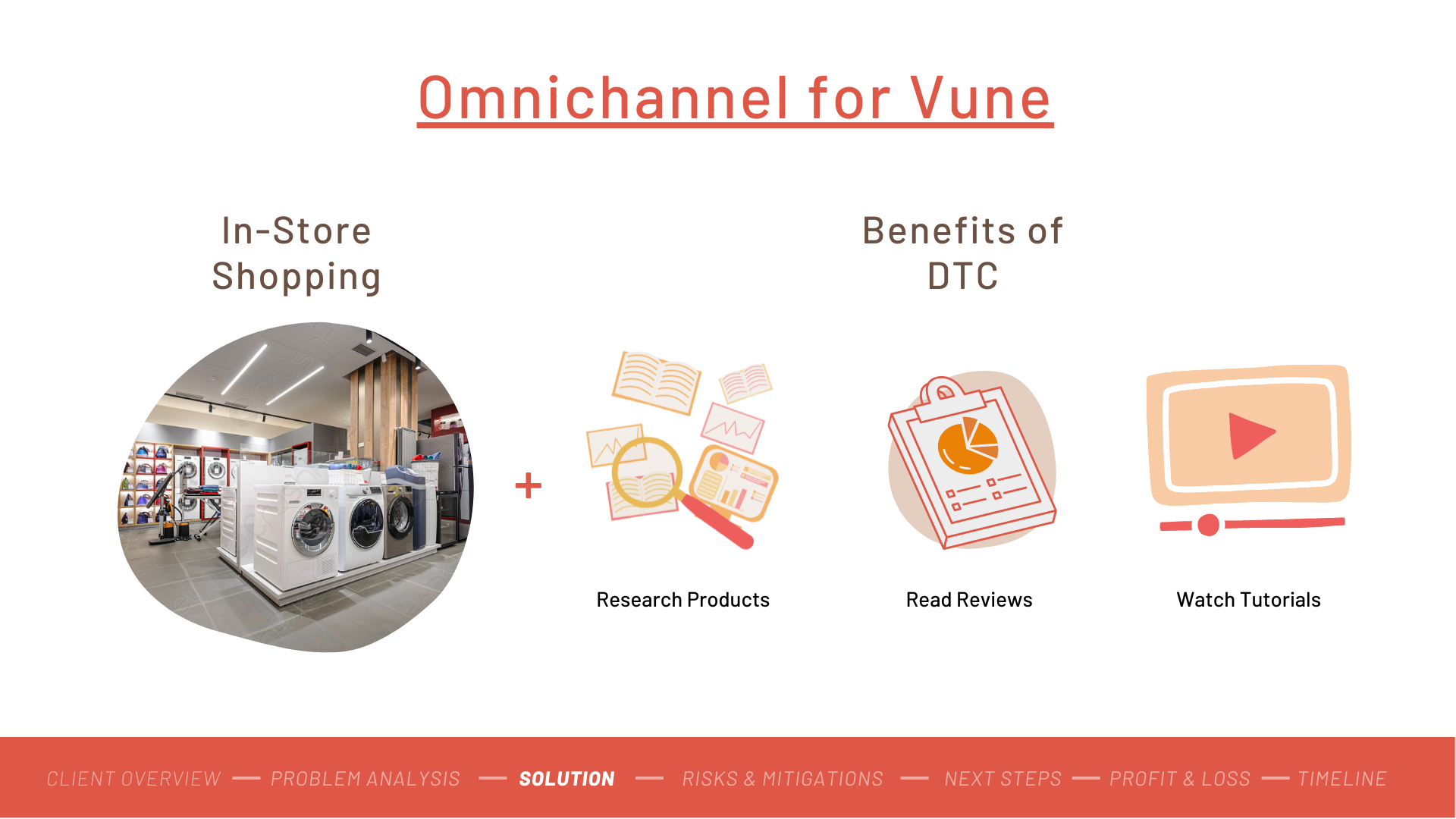

Integrate an Omnichannel solution where we utilize bypassing retail stores

Business Model Pros/Cons

Brick and Mortar

Pros

Allows consumers to test out products at the store, more likely to purchase when they know what they are getting

Instant gratification, higher loyalty retention rate

Builds relationships with customers through a face to face interaction

Advertising in store has much more opportunities as this includes, graphics around the store and “persuasive” sales tactics

Cons

Not convenient for buyers that are not within the area, time consuming, less attractive than online

Physical stores require higher costs of running the store for longer hours

Stores can only offer a certain amount of products till they run out of stock at that given time

Hours of the store can be inconvenient for that specific consumers

Direct to Consumer

Pros

Allows for more insightful consumer behavior data, can be used to gauge future plans

In 2021, 96% of Americans shop online vs 65% of shopping budget spent in store (conducted by Big Commerce in partnership with Kelton Global, collected from 1000 nationally 18+ years Americans making purchases within the previous six months)

According to Raydiant’s second annual State of Consumer Behavior Report, 66% of respondents said that given the choice, they prefer to shop in person rather than online

Avoids large listing fees from a third party like Amazon

Able to rely on reviews of others

Cons

Cybersecurity risks, information leaks, will take up a lot of money on this front

Opens a new set of risks that were previously dealt with by a third party

If the brand is not established enough and there isn’t already a relationship formed with consumers, going DTC is difficult as the company needs manage every aspect of the sale

Consumers not able to test/view products before buying

Top Competitors

99,000 employees

Grown more than 18% since 2015

Topped $32 billion in 2020

In 2021, Organized experiment where employees manage themselves into thousands of microenterprises that respond directly to user needs. It took away 12,000 middle managers (eliminated bureaucracy)Adopted HR shared services platform

850 employees down to 11

Struggled in the beginning of pandemic as their main problem was direct interaction with users was not efficient.

Focused on creating products for different scenarios instead of thinking about how the product works on its own

To combat the issue of not enough interaction with users, after they removed 12k employees, they created 4,000 microenterprises consisting of two types of ecosystem micro communities. (300+ self-organizing EMCs)

Experience EMC

Directly communicates with users

Understand what users want

Solution EMC

Applies the feedback to create solutions to satisfy user needs that has been identified by Experience EMC

April-June of 2022, $371 million operating loss, compared to $488 million in profit in the same quarter last year.

Revenue fell 20% in 2022

Decrease in panel shipments in 2nd quarter as China’s COVID lockdowns disrupted supply chain

Prices for 55 inch LCD panels for TV sets fell 12% in April-June compared to Jan-March

LG Global Pandemic Response

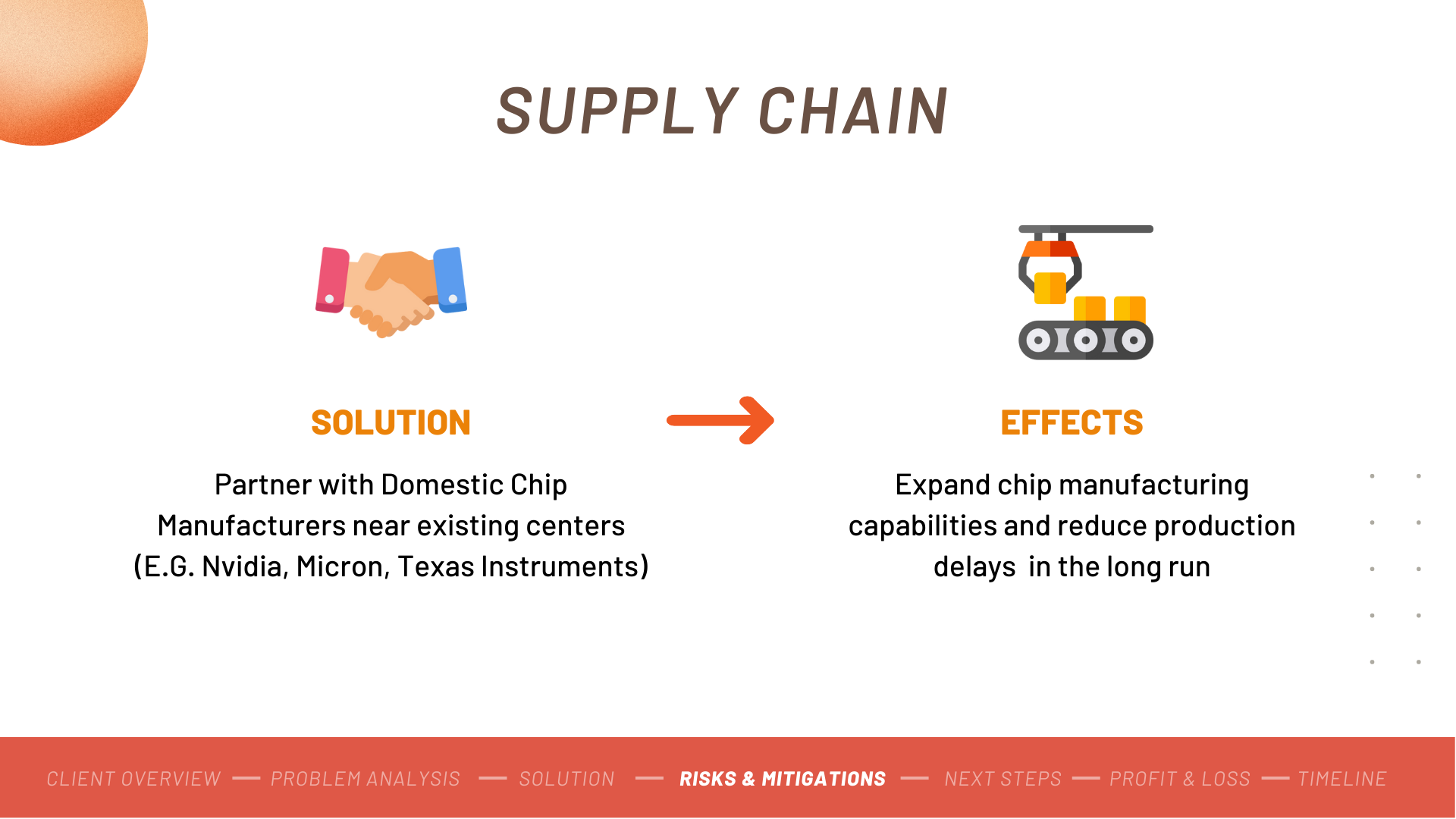

Supply Chain

In 2021, increased value of interest-free loans offered to suppliers to 46.6 million compared to 33.9 million from four months earlier.

Operated a win-win cooperation fund worth $169 million for low interest loans in partnership with Industrial Bank of Korea

LG Electronics to expand cloud-based call centers amid Covid-19 pandemic

Launched cloud-based call centers in the US and 10 more countries, including Brazil, France, Vietnam, and South Korea.

Allowed employees to work from home and expanded the system to help customers speak with assistance swiftly.

Call centers provided new updates and services to keep customers engaged as they now had to mainly advertise on the ecommerce front.

LG Announces Organizational Changes to Respond Faster to Unprecedented Business Environment

Established separate divisions for refrigerators and dryers under the H&A Living Appliance Business while Air Solutions Business will get a separate System Air Conditioner division.

Gave management and employees direct responsibility for growing categories

Focused on accelerating Micro LED tech for faster business development